Not since the advent of modern shopping malls has there been such upheaval in the retail sector.

The COVID-19 pandemic causing a monumental change in global shopping behaviour as the steady growth in e-commerce suddenly exploded, accelerating the shift away from bricks and mortar by about five years. With lockdowns widespread, foot traffic disappeared from high streets and commercial business centres as a virus ripped up the book on how the world traded.

At the same time, e-commerce ignited all over the world, but particularly in nations where it had barely smouldered. Online sales increased by 66 per cent in Brazil, 54 per cent in Mexico and 45 per cent increase in Russia.

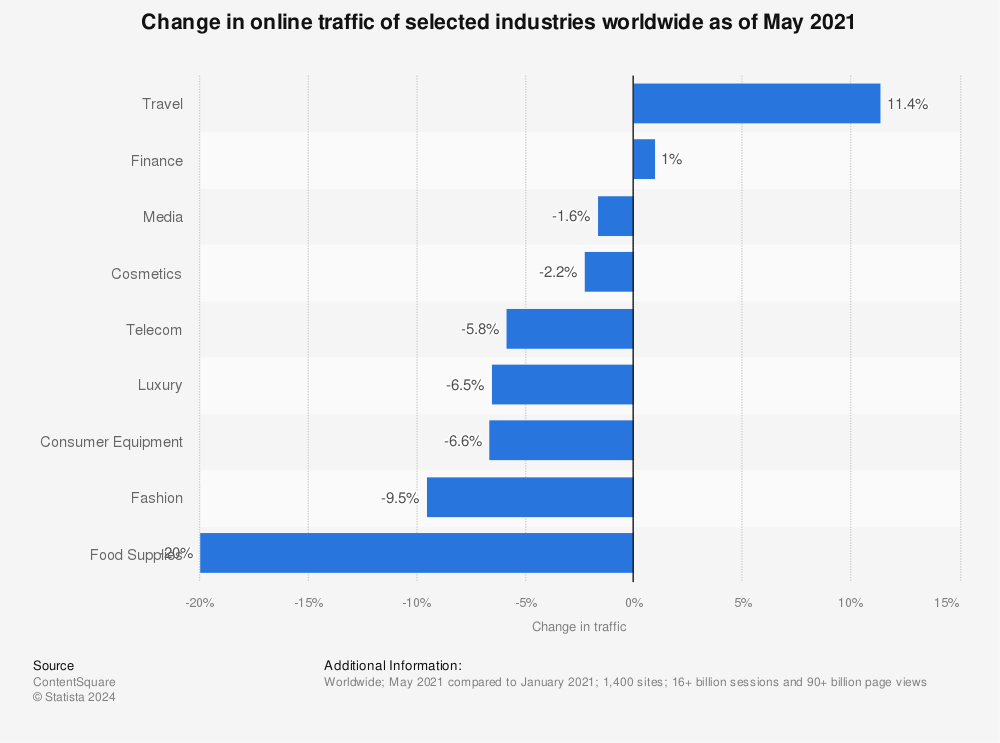

Consumers spoke clearly about items they considered essential. Sales of groceries, alcohol and home improvement materials accelerated but people largely decided to make do with what they had when it came to items such as clothing.

A record number of shops closed down on UK high streets during the first half of 2020 – and that was before one of the highest profile casualties, the Arcadia Group, went into administration in November 2020. Arcadia’s big brands Topshop, Topman and Miss Selfridge found a new home with the online retail giant ASOS but tellingly, its brick-and-mortar stores did not.

As one UK academic put it, the ASOS deals were “another nail in the High Street’s coffin“. The company’s chief executive Nick Beighton was quoted as saying: “It’s not our model to operate stores.”

“It’s fair to say there had been a move to online prior to lockdown, and the lockdown has accelerated that massively,” says Rajeev Shaunak, Partner at MHA Macintyre Hudson.

“People who relied on the bricks and mortar have suffered massively, like the Arcadia Group, and you’ve got Debenhams which has failed as well.

“The high streets or the bricks-and-mortar are suffering, smaller shops are unable to meet the fixed costs, and that’s a trend that’s been happening anyway. Cost pressures, the rise of international e-commerce competitors, the Amazonifacation, as I think people are calling it.”

The question is, should physical stores still be in anyone’s model?

The rise of e-commerce

Retail e-commerce sales worldwide are expected to hit US$4.9 trillion by the end of 2021, when online sales will have made up more than 18 per cent of the global market. That penetration is impressive in just 20 years, yet it’s only the beginning. By 2040, e-commerce could be responsible for 95 per cent of purchases.

E-commerce has thrived in places where it has previously only made up a fraction of the retail picture. It been a remarkable change in a very short space of time says Manuel Aguilar, Managing Partner at Baker Tilly Mexico.

“The growth of e-commerce retail in Mexico was 81 per cent in 2020 against 2019 and it now has a value of US$15 billion,” he says.

“The industries or retail markets that grew most related to food and groceries, then technology, followed by home appliances and fashion.

“Now the online retail market in Mexico represents around 10 per cent against the overall retail market in the country, which practically 10 years ago was non-existent.”

Elena Dmitrieva, Partner, Corporate Finance at Baker Tilly Russia, says there has been a big drop in the value of sales at bricks-and-mortar outlets – but not necessarily total sales.

“I looked for statistics for the summer, they say sales in the shops dropped by 75 per cent in the spring and summer months last year, but the volume of sales to the public, to people, hasn’t dropped that dramatically and that was because of e-commerce,” she says.

“I think that the average household now spends more than 50 per cent of their day-to-day expenses in internet purchases rather than in real shops, so that has been a big switch.”

“The average household now spends more than 50 per cent of their day-to-day expenses in internet purchases rather than in real shops, so that has been a big switch.”

– Elena Dmitrieva

Russia was not locked down in the same way that other places have been, says Baker Tilly Russia research consultant Maxim Tambiev, yet data indicates that internet retail volumes in 2020 was around 10% of the total retail spent in Russia, growing at about twice the rate of the previous year.

“E-commerce logistics grew around 20 per cent for the years 2016 to 2019 but it grew around 35 per cent last year, in terms of the number of shipments,” he says.

“Our leading electronics retailer, they are now selling more than 60 per cent of the total sales online.

“Half of the Russian population purchases something or interacts with e-commerce at least twice a year, out of the whole group of internet users in Russia. Of the buyers, 77 per cent do purchases at least once a month and 25 per cent at least once a week – that’s 25 per cent out of half of the adult population, basically 15 per cent of the total population in Russia makes internet purchases at least once a week.”

Changes in retail behaviour

E-commerce was the driving force behind a retail recovery in Brazil at the end of 2020, notes Leonardo Maia, Partner at Baker Tilly Brazil, as the sector drew a line under a challenging year with a strong fourth quarter. But he also observed that the pattern of consumption is changing.

“In Brazil we have Magazine Luiza, a very large retail company, and they actually are very strong e-commerce as well, and what they are noting is that the consumer, the population, are actually demonstrating different behaviours,” he says.

“In the past, the consumer goes for one channel and now we have what they call multichannel. So we have the consumer that still goes shopping, goes to the store itself and we have people that go online, and the retailer understands they are going to migrate.

“They understand this, so they are going to create a cross-channel dimension, a synergy between one channel and the other. So the client is going to use the best of the physical store with the best of the e-commerce platforms.”

The explosion in e-commerce isn’t just limited to retail. Mr Maia noted financial services, education, streaming services are all evolving.

“This increased with a velocity never seen in Brazil,” he says. “2020 was a breakthrough for this market and we advanced light years in this changing behaviour.”

E-commerce and trust

The basis of a good e-commerce system is the trust that customers have in the platform and laying the groundworks is a team effort, says Mr Tambiev.

“Marketplaces and ecosystems are such buzzwords nowadays, everyone’s talking about marketplaces,” he says.

“You shouldn’t put all the power in one hands in this project, neither in the hands of the sales or marketing person, nor in the hands of the IT. You should have a team of top-managers responsible for marketing / sales and IT working closely together in order to build an e-commerce system properly.

“There are plenty of technology, there are plenty of offerings, both local Russian-made or international platforms that you can take and adapt and implement in your organisation.

“But the largest problems are always not with the technology, the largest problems are with the processes and the understanding of what you are doing and what should be in the aims of the projects.

“E-commerce platforms are no different than any other digital transformation project.”

Mr Shaunak says organisations who are new to the e-commerce world should be aware of the challenges that come with establishing online platforms.

“There’s risks in cyber security, customer experience, order fulfillment, you know, making sure that experience in the fulfillment happens,” he says.

“Because it isn’t someone turning up to the store, you see the product you buy, the order is fulfilled. But going online, you’ve got to be able to replicate that, in a way, by making sure it’s a slick operation.

“Make sure you know your customers, but also don’t make the same mistakes that some of the others who rushed into it did, by not charging for shipping, for example.

“(E-commerce) isn’t someone turning up to the store, you see the product you buy, the order is fulfilled. But going online, you’ve got to be able to replicate that, in a way, by making sure it’s a slick operation.”

“It’s making sure you’re actually able to reach out to consumers and they’re actually confident in being able to return items, because I think the problem the smaller entities are going to have is that credibility issue.

“You’ve got to have a good returns policy and I think partnering up with stores, even having a concession or a distribution or a collect channel through a physical presence, is going to be important.

“Whether people use it or not, it gives that credibility and that awareness that if you need to return something, or there’s an issue, there’s an actual point you can go to.”

Mr Maia says the retail business has become more complex because the risks with e-commerce are different.

“We have whole new world, with data security, cyber security and that is something that definitely must in place because there is no e-commerce without cyber security. We have a very new and strong law in Brazil in that regard.

“It’s a new business with some actually old risks, but some new and increased ones.”

The new look high street

Brendan Sharkey, the head of construction and real estate at MHA Macintyre Hudson in the UK, does not believe the end is nigh for high streets but admits the landscape may look different.

“The high street as we know it is not sustainable and that’s due to competition from city centres, retail parks and shopping centres,” he says.

“It’s not dead, but it will be smaller with a sharper convenience and community focus.

“The high street as we know it is not sustainable and that’s due to competition from city centres, retail parks and shopping centres. It’s not dead, but it will be smaller with a sharper convenience and community focus.”

“High streets are undergoing a realignment in their offering which will mean, in part, that there will be less demand for retail space because there is just too much of it available. If rents are manageable, and there is enough local residents or workers to support outlets with convenience shopping, food, restaurants, meeting places, healthcare, dry cleaning and the like, high streets should prosper.

“High streets are even more likely to thrive if planning changes allow existing shops to be repurposed as offices or residential.”

Mr Aguilar says the challenge of making shopping centres once again an attractive option for consumers is one of the challenges facing commercial property landlords.

“Retailers are negotiating with landlords about decreasing the existing capacity of physical retail, that’s something that will be permanent for sure,” he says.

“As well, they need to find ways to stimulate the public to go back to the stores, once the pandemic is under control, and do things differently.”

Growth in e-commerce was borne of necessity, but Mr Shaunak believes consumer behaviour has changed for good.

“Many of the bigger brands sort of relied on their bricks and mortar history, and a bit of a misplaced sense of customer loyalty, and that showed with the failure of these long standing chains,” he says.

“It’s been the brands with a limited online presence, purely focused on physical stores that are suffering and that’s going to have an impact going forward, it’s not going to be enough for a high street store to be purely a points of distribution.”

Ms Dmitrieva says online marketplaces that connects suppliers with manufacturers may be part of the next wave of e-commerce growth.

“There is a lack of marketplaces that could connect businesses to businesses for products that will be used in further production,” she says.

“This is e-commerce not for public consumption but a B2B marketplace, the connection between the producers and the companies who use their goods for the further production.

“In Russia, we really struggle from the lack of the information from a lot of entrepreneurs and sellers who are not very deep in the production process and cannot really build to the right connections, when we talk about heavy duty spare parts, or construction materials.”

The future of retail

Visits to UK retail outlets have vanished in the last year, with the average retailer bearing a 55 per cent drop-off in foot traffic during the post-Christmas period, compared to 12 months earlier, and higher in many places under Tier 4 lockdowns.

It’s a similar story in many parts of the world. Consumers won’t necessarily return in the same numbers they did, which means shopping centres and high streets will have to re-examine what they offer. Mr Maia says physical retail experiences in future will be more about connection.

“Shopping malls should be something that is less related to shopping and more like an experience, with food and entertainment,” he says.

“The retail chains and the property investors themselves should be looking to provide more a social experience than actually a place to shop, when people are able to do that again. Something related to entertainment, a park for children, cinema movies, food, library services, whatever services you need.

“They are all looking for shopping malls that should be this convenience place, mixed in with a place that you can actually have a great living experience, more the experience than the shopping.”

Mr Sharkey says the visual element and opportunities for upselling have been overlooked in the gloomy forecasts for physical stores, and consumes are looking for a stimulating experience that is better than searching websites.

“John Lewis, a fantastic brand, are closing less profitable stores and looking to reconfigure their existing floor space for offerings such as serviced offices, food preparation demonstrations and supply, healthcare treatments and potentially residential,” he says.

“Major retailers will retain bricks and mortar outlets where there is good footfall to display goods, while offering customers an experience through knowledgeable sales staff.

“They will also be online with less stock held in their retail outlets. But stores can offer click and collect and make returning items simpler, and upselling and value adding is also done more easily in a face-to-face environment.”

Mr Shaunak noted that the Fuji camera brand had started tapping into this trend even before the spread of the pandemic.

“There’s different strands, so for the luxury market, when you’re buying a Rolex you want to be sat across someone is offering you a drink, and, you know, you can actually see and touch it.

“But I think for the other retailers, it’s going to be the experience. Literally just before the lockdown, Fuji cameras open a store they call the House of Photography. The aim is not to sell and I think they sell very little actually through that store.

“People go out, they can actually play around with the cameras, take their master classes, and that seems to have driven quite a lot of online sales as well.”