EU authorities plan to claw back billions in ‘missing’ VAT from online booking platforms, as part of wide-ranging digital tax reforms, in the latest battle against digital giants.

Online booking platforms are targeted as part of wide-ranging digital tax reforms, in the latest battle against digital giants.

As the tourism sector across the EU experiences one of its best seasons in recent years, a battle is going on behind the scenes between accommodation platforms and tax authorities over who should be collecting VAT.

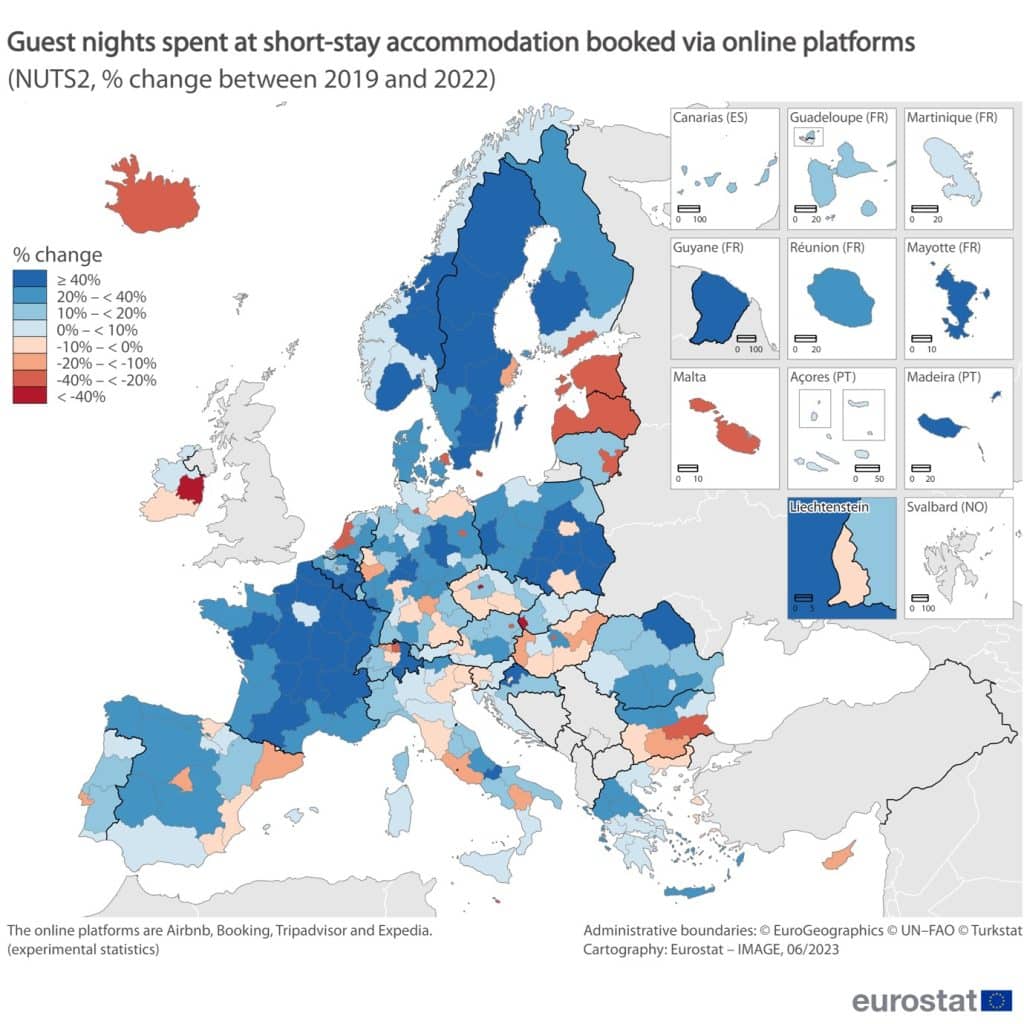

More than half a billion EU overnight stays were booked on the four biggest digital platforms, Airbnb, Expedia, Booking and TripAdvisor in 2022, about 40 million more than the pre-pandemic peak.

In the first quarter of 2023, usually a quiet period, nearly 85 million nights were booked through the four giants.

But although platforms generate an estimated €43 billion in platform revenue and payments to accommodation providers, less than €4 billion is paid in VAT — a far lower rate of recovery than on other platform ecosystems such as e-commerce.

Back in December 2022, when it launched its multifaceted VAT in the Digital Age, or ViDA reforms, designed to help close a €93 billion VAT gap, the European Commission singled out booking platforms for particular attention.

In what was described as a bid to create “a more level playing field between online and traditional short-term accommodation services”, the ViDA package includes plans to hold booking platforms responsible for VAT collection and remittance on the sales they facilitate when the underlying supplier has not done so.

The change is tipped to bring in up to €6.6 billion per year over the next decade in additional VAT revenues for Member States over the next ten years, while saving platforms and providers an estimated €48 million per year over the same period in streamlining operations.

The proposed changes are not limited to accommodation platforms — passenger transport platforms will also be covered — but given the large number of small businesses, individuals and families using popular platforms they are likely to see a greater impact as property rental prices rise.

The ViDA reforms sit alongside DAC7 changes that will also affect suppliers who list properties on booking platforms.

An annual reporting obligation that commenced January 1 this year will see the platforms report annually to tax authorities about data including revenue, number of bookings, days listed and taxes withheld for each business or individual who lists property.

Another front in the regulator battle

For the big digital platforms, the ViDA reforms represent yet another front in the growing battle by regulators and local authorities to either curb the influence of short-term rentals or at least capture a greater share of the money the sector makes.

And for small providers, it provides a hint of what is to come as EU countries take steps to reduce the VAT tax gap afforded by inconsistent laws.

“We are beginning to see this trend in several proposals,” says Marisa Hut, a Partner in VAT & Customs Advisory at Baker Tilly Netherlands.

“The European Commission tries to improve its control on transactions and to do this, they implement regulation which makes it easier to pay the VAT that is due while also trying to limit the number of taxpayers who have to pay.

“It is far easier to collect VAT from one platform than from potentially 10,000 users, so this is the kind of smart regulation and policy measures which will increase VAT revenue significantly.”

Digital booking platforms have historically resisted the role of tax collector.

While Airbnb has collected consumption taxes such as GST for properties in Canada since mid-2022, that approach tends to be an exception rather than the rule.

Instead, Airbnb merely warns that hosts whose country of residence is in the EU “may need to assess VAT” on the services they provide and encourages them to get advice to do so.

Booking.com describes its platform booking system as an agency model, and says reservations are considered a direct transaction between a property host and the guest.

That pushes the responsibility for tax back on to those listing property, who need to be “familiar with any local taxes and laws that are applicable to these transactions”.

The European Commission’s proposal offers a radical rethinking of this approach.

It plans to reclassify small accommodation providers who have uninterrupted rentals for 45 days as having a similar function to a hotel, with VAT to be due at the same rate as would be applied for a hotel stay.

But answering questions on the detail of the policy in March 2023, Carmen Muñiz Sánchez, the responsible Head of Sector in TAXUD’s VAT Policy Unit, said it would be challenging to require each individual who rented out an apartment or their own home to register for VAT and comply with VAT rules.

“It would be very difficult, to put it mildly,” she says.

“That’s why our proposals don’t compare the individuals (who are) renting apartments with hotels. We compare the platform itself to a hotel, in the sense that a hotel might have a hundred rooms and then you have platforms which list hundreds of offers in the same city.

“So in our proposal, we suggest that the platform be considered the ‘deemed supplier’ – meaning that it is the platform itself that will collect the VAT on behalf of the individual user and remit that VAT to the Member State authorities.”

Tax law struggles to keep pace with technology

Gary Brough, a partner with Baker Tilly Turks and Caicos and a tourism sector specialist, says tax law has tended to struggle with digital platforms and the European Commission plans will rile some platform operators.

“With new technology and new initiatives there is often a short-term mismatch in terms of compliance with existing laws and regulations because such innovations were never envisaged when the core of the relevant legislation was first enacted,” he says.

“Such is the case with VAT on booking platforms in the tourism industry.

“The days when the primary source of booking your vacation was via a visit or call to the physical office of your friendly local travel agent are long gone.

“The evolution of the internet and the growth of online travel platforms has created greater personal choice and control over vacations for the consumer, and the entry of the sharing economy concept has created new opportunities on the supply side for home owners and developers to be providers of accommodation.

“Even though tax legislation is a rapidly moving feast, much of the core legislation never envisaged this current landscape.”

Of course, resolving the VAT issue is just one of the regulatory challenges booking platforms are facing — and many have long been on a collision course with local authorities.

Inside Airbnb, a company that shares data on what it calls the reduction of genuine short-term rentals, argues that in Paris, for example as many as one in three properties is not officially licensed.

Given there are more than 56,000 apartments, rooms and homes listed, 30,000 of them booked at least once in the past 12 months, a team of agents has been set up to pursue illegal rentals and fine individuals and multi-site operators who fail to register.

Cities from Florence to Edinburgh are trying to curtail the booming short-term let market, and after a series of bruising legal actions against platforms in various jurisdictions, it appears authorities may be gaining the upper hand, not only in forcing platforms to share data but winning some crucial battles on the application of tax law.

Airbnb has recently moved to collect some other local taxes that can apply in different jurisdictions, such as Italy’s so-called tourism tax, in which more than 1000 municipalities apply their own tax rate, set based on a range of factors such as the age of the guest or the star rating of the accommodation.

Booking.com is also in the spotlight, with Italian prosecutors investigating historic VAT payments.

Mr Brough says the push to make booking platforms responsible for tax, while complex, also reflects the demands of traditional tourism providers such as hotels which have often worked hard to build the brand of tourism areas, only to feel they are being undercut by new smaller entrants who often skirt tax rules.

“This issue is much bigger and more complex than the EU authorities considering levying VAT on booking platforms,” he says.

“Similar challenges are faced globally and extend to other tourism-related taxes such as accommodation (bed) taxes and how those taxes are being used —whether the raising of those taxes for expenditure on tourism-related projects such as infrastructure, airports for example, is being equitably allocated to those who use that infrastructure.

“The complexity is enhanced because you often have to look at tourist markets jurisdiction by jurisdiction as many destinations have different tax structures and different tourism development plans.”

While platform operators will likely continue to object to the heightened compliance — along with some small providers who will see their accommodation become more expensive — Mrs Hut says landlords, small businesses and property owners will benefit from additional clarity.

“Smaller landlords are often not aware of their obligations and nobody likes to be confronted with such costs in hindsight,” she says.

“Introducing a model in which the platform is responsible for collection is also a benefit for the landlords behind the platforms because they could potentially get a VAT audit and assessments for the unpaid VAT due if they are liable.”

“The platform will most likely control the cash flow and return revenue minus platform fees and VAT instead of sending all the revenue back and hoping the landlord pays.”

“We think this legislation is fairer for traditional hospitality and tourism businesses as they will actually pay the VAT due.”

For smaller providers who might not be across their VAT obligations, it is time to take the matter seriously, Mrs Hut says.

“Platforms should align with the landlords using their website and discuss which party will be responsible for paying the VAT (or take matters in their own hand and just determine that the platform will pay the VAT due),” she says.

“Subsequently platforms should adjust their system, so the platform has access to the money flows and can pay the VAT due (automatically) out of the money received from the end consumer.

“An effort is needed from all parties involved in order to ensure that they are ready for the future.”