Regulatory challenges and legal inconsistencies, especially in the US, create complexities for the Cannabis market.

The global market for medical cannabis is doubling every few years — but regulatory hurdles and compliance are also triggering a boom in demand for professional advice.

There’s nothing mellow about the global market for medical cannabis.

After years on government blacklists, the legal sale of cannabis has grown from a tiny market — confined largely to a few American states, Uruguay and the Netherlands — to a global market allowing wholesale cultivation, a distribution network and over-the-counter sales in more than 30 countries.

The cannabis industry is tipped to more than triple within four years to more than $47 billion.

It’s a rapid change that has seen the legal cannabis sector grow from an estimated USD $10 billion in 2018, the year Canada joined the ranks of just a handful of legal locations, to an estimated $15 billion market in 2019.

It is tipped to more than triple within four years to more than $47 billion.

The sudden emergence of a new, seemingly untapped consumer market has countries around the world reviewing laws and considering whether to allow their farmers and producers to engage.

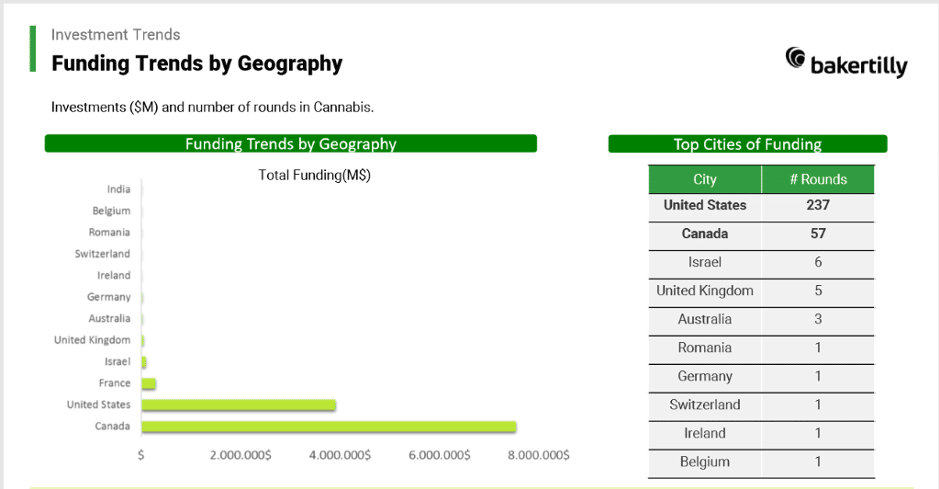

North America leads the way with medical — and recreational — cannabis use, and Canada is the stand-out player. But other countries are rapidly getting on board.

Germany is Europe’s largest market for medical cannabis, importing more than 6700kg in cannabis flowers in 2019, mostly from Canada, but is expected to start domestic supply late this year.

Its laws, in place since 2017, could become the blueprint for other members of the EU27.

In South East Asia, Thailand has moved towards decriminalisation for medical cannabis, the Philippines is considering making cannabis an exception to the country’s crackdown on drugs, while Singapore is maintaining a strong stance against softening its drugs policy.

Even in Indonesia, which has some of the strictest anti-marijuana laws in the world, a conservative lawmaker suggested legalising exports of cannabis from the province of Aceh, known for its abundant illicit crops.

Other countries to permit the cultivation of medical cannabis include Lesotho, which became the first in Africa to issue licences in 2018, Zimbabwe in 2019 and South Africa, which has also decriminalised private cannabis use.

Eswatini and Uganda are also set to change their laws, though concerns remain about whether crops from all of the emerging African producers will meet stringent export quality.

Negotiating the legal minefield of a new industry

Amid the enthusiasm of joining the ‘green rush’, there is a sobering realisation that trading in this new commodity is highly complex, given the differences in legislation and market maturity between countries.

Baker Tilly International Director of Services & Industries Jake Luskin says that as with any new industry, there is a race to position, and without expert advice some firms could be left behind.

“If you look at the boards of these companies, you are getting very sophisticated high profile people, former CEOs, CFOS, people who might have come from the mining industry, pharmaceutical industry and Fortune 500 companies,” he says.

“The leadership teams are good operators but their rapid growth, largely through acquisition of SMEs, is creating challenges. It’s a brand new industry with continuously evolving laws and regulations at a global scale. In that kind of environment, companies need some help.”

As a global professional services network, Mr. Luskin sees Baker Tilly International firms as uniquely positioned to help deal with these challenges.

“Our core business is helping SMEs grow now for tomorrow. Whether it be nurturing them through early stages of development, advising on deals, helping fuel growth through global expansion or helping with corporate governance and compliance.”

The challenge of compliance is substantial — complicated by legal inconsistencies, particularly in the largest markets in the US.

American lobby group Marijuana Moment estimates nearly 1000 cannabis-related bills are moving through US state legislatures and Congress, as of early 2020, with each state making its own rules, even among the 33 who have introduced some kind of law.

Some states, such as Florida and New Jersey, have specified the medical conditions that are required before a patient can be prescribed cannabis. Others, like Oklahoma, leave the discussion up to the patient and doctor, while Kentucky and Tennessee remain staunchly opposed. And even though 11 states have fully legalised marijuana for adult use, it remains — as of now at least — illegal under US Federal law.

“Just as with exploration companies, which might have no revenue but where investors can be prepared to invest hoping they might strike it rich, we are seeing a similar picture now with the cannabis businesses so that’s why they’re flocking to Canada.”

California, the largest single market in the world for cannabis, still has a mix of rules that make it hard for businesses to operate, from hurdles on deducting business expenses, to requirements for local and state licences, to barriers against using mainstream banks.

There is also a thriving black market, with a recent report suggesting illegal operators outnumber legal ones by 3 to 1.

It is a situation that can deter investment, and which has seen many US businesses look to list over the border.

There are more than 20 cannabis-related stocks listed on the Toronto Stock Exchange and more than 40 on the smaller TSX Venture Exchange.

“Toronto is used to speculative investors investments and the mining sector is the parallel,” says John Sinclair, Managing Partner of the Baker Tilly Canada’s Toronto office.

“Just as with exploration companies, which might have no revenue but where investors can be prepared to invest hoping they might strike it rich, we are seeing a similar picture now with the cannabis businesses so that’s why they’re flocking to Canada.

“It is easier to list in Canada than in the US where you have to deal with a lot of the SEC oversight and on the same note, in Canada, you can list at an earlier stage both in revenue and company size.”

Mr Sinclair works with his network colleague, Advisory Services Partner Scott Moss from Cherry Bekaert, helping cannabis businesses professionalise, which means operating with the level of compliance and commerciality that investors expect.

Mr Moss has successfully advised clients in all aspects of due diligence, heading Cherry Bekaert’s Private Equity Industry which includes a Transaction Advisory Services team that worked on 259 deals during 2019, with a transaction value of $6.8 billion.

Cherry Bekaert’s valuation practice performs more than 400 equity and debt valuations annually for private equity funds and publicly traded business development companies.

“I see a lot of firms who have attracted capital given the frenzy of investor interest, but who now have outside investors saying, ‘hey, I want to know what’s happening with my investment, where’s my return going’,” Mr Moss says.

“All the simple things like basic accounting and corporate governance come into play and at a more rapid pace.”

Critical for the growth of businesses is being able to demonstrate that they are serious operations — able to provide consistent, high quality cannabis for medical use, with the appropriate controls, governance and management to perform in a complex, competitive market.

It’s a bar not every company will be able to clear.

Mr Moss says the quality controls on medical cannabis in most places were strict and in Canada, for example, tracking is in place from the point at which the seed is put in ground throughout the process of growing, harvesting, processing and sale.

“Businesses need to track that process so if there is an issue, like a recall or some health issue, you can trace it all the way back to the producer,” he says.

“But I think where that really becomes interesting is that given local supply is not keeping pace with demand right now, you have groups who have to buy their product from other sources and that might mean global growers.

“How do we ultimately develop a single mechanism that tracks provenance no matter what country you’re in, so if you’re purchasing product from Jamaica or Spain, it has the same rigors of tracking that Canada does for their seeds?”

Mr Sinclair agrees, and believes Canada’s maturing medical cannabis market will help set the standard for countries only now entering the sector.

While US Federal laws make international exports difficult from the US, Canada continues to look offshore and secure licences in countries now joining the party.

As the first country to develop a comprehensive legal framework, Canada is hoping to influence the way the market develops in other emerging locations.

“I can guarantee that our requirements are going to force the same level of standards on countries if they want to supply to Canada,” Mr Sinclair says.

“People are just not going to allow you to start selling unregistered product to Canada. Everything would break down. So whether it’s a Canadian standard or an international one I think one will eventually be developed.”

In the meantime, both advisors believe investor and buyer demand will mean companies keep turning to professional services for advice to ensure they can play in the multi-billion dollar market.

“We have seen early stage mindsets among companies that have raised a lot more money than they might have expected and they need help,” Mr Sinclair says.

“It’s one of those situations that doesn’t come along very often when you have businesses that are suddenly in the money before they have gone through process of maturing and becoming professional.”

Private equity broadens its cannabis sector play

As any mining sector investor will tell you, you don’t have to dig the gold if you can sell the picks.

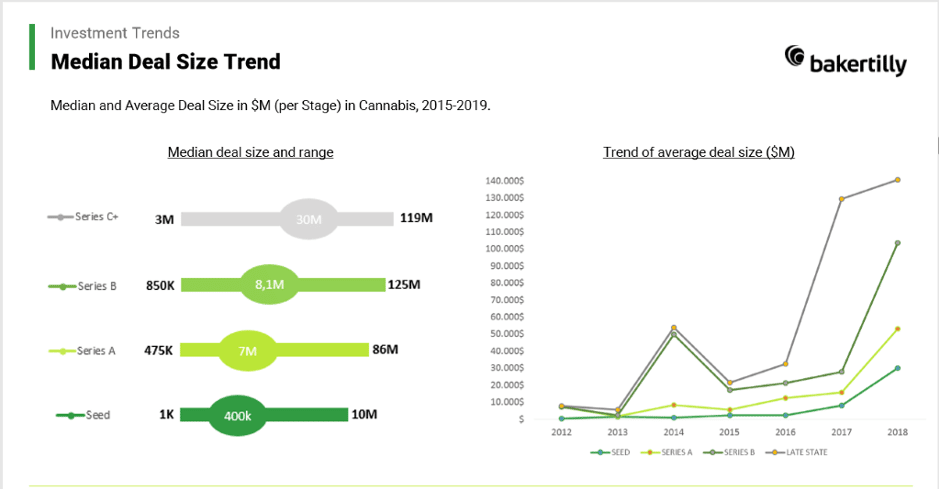

It’s an adage that holds true for the emerging cannabis sector as well, with growing venture capital and private equity interest in businesses that interact and support growers and distributors — the ancillary cannabis market.

With three to four times more ancillary businesses than cultivators in the US — most unhindered by the licensing and legal challenges faced by growers — there is good reason for the investor appeal.

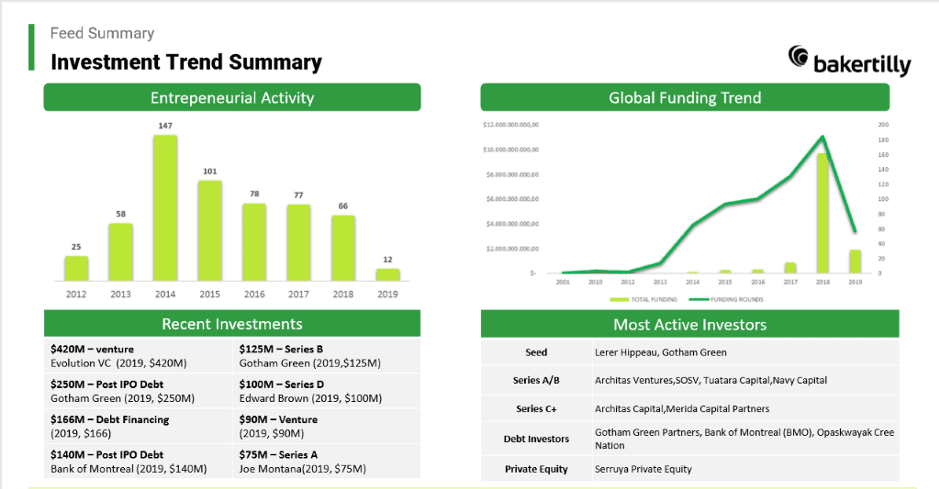

“There are now more than 70 active PE investors throughout the US and Canada who are focused on the cannabis industry,” says Cherry Bekaert Advisory Services Partner Scott Moss, who has followed the rising interest in the sector.

“While these funds are in North America, they recognise the global cannabis economy and their investment reach is not isolated to just the US and Canada.

“The market used to be very speculative but now that there’s a little bit of a maturity the interest is becoming more attractive to venture capital and private equity funds.

“In stage one of the market there was mainly interest from angel investors. Stage two became about venture capital. We are now in stage three — the stage for corporate buyouts and PE.”

During 2019, the US and Canadian industry experienced their highest level of M&A activity, the majority of which was fuelled by venture capital investment and corporate acquisitions.

More cautious than venture capitalists and more sophisticated than angels, PE investors were looking across the cannabis supply chain, Mr Moss says, rather than concentrating on plant-touching businesses engaged in cultivating, extracting or distributing.

“The major segments are in electronics, which can be the vaping technology, the area of medicine and medical devices, software application, communication services and treatment technologies,” he says.

“What we’re seeing is a lot of the investment being made in ancillary businesses, that don’t necessarily face the same regulatory and licensing concerns that you see with the plant-touching companies.

“So they may be the technology components or providing other aspects that are important to the industry and will benefit as the industry grows, without facing the same hurdles.”

PE investors come with deeper pockets but also stricter expectations of companies to perform, Mr Moss says.

“Certainly in Canada, where the capital market tends to be a bit more speculative, we were seeing a play off what Canadian investors were used to in the mining industry — high net worth investors or Canadian venture capital funds making initial investments,” he says.

“Now funds are providing an opportunity for both qualified individual investors, as well as institutional investors to diversify their investment capital allocated to the cannabis industry.

“Investors look at the funds and say if I can do my investing through a fund-based platform, it spreads my money around a larger group of target companies and hopefully enhances the degree of success I have on this investment.

“The idea is swing for the fences and hit a home run, but accept you will have some strike outs along the way.”

With the legal challenges experienced by companies operating on the front lines of the cannabis market — including ongoing difficulty in accessing traditional banks — some PE funds are also seeing opportunities to disrupt the finance model.

“We have seen one of the PE funds invest in a lender willing to lend to companies operating in the cannabis industry, so we will start to see some non-traditional financing sources become available,” Mr Moss says.

“That means you will see companies not relying exclusively on traditional banks.”

With an expansion of PE into the sector, Mr Moss says the outlook overall has improved — and will continue to do so once US regulatory issues are resolved early market entrants will likely be rewarded handsomely.

“You definitely saw a little bit of a pullback in the fall of 2019 but overall the market potential and trends remain positive once you get over some of the regulatory issues,” he says.

“I think the world is looking to the US and waiting for us to make some decisions on legislation, assuming that those decisions reduce the regulatory hurdles. If they do then I think it’s an industry positioned more strongly for growth than anything we have seen since the United States repeal of prohibition in 1933.”